Credit Card Statistics: Global Facts, Data, and Figures

5 min. read

5 min. read

The advantages of having a credit card and using it responsibly can be rewarding in so many ways. It gives you the extra purchasing power to spend on your needs and occasional indulgences. Additionally, spending with credit cards is accessible by design. Whether you're shopping or availing of auto-charge subscriptions, all it takes is a swipe or a tap.

Apart from its convenience, credit card owners also enjoy pricing benefits, installment payment plans, and reward programs. Because of its many perks, 80% of consumers prefer spending with their credit cards over cash.

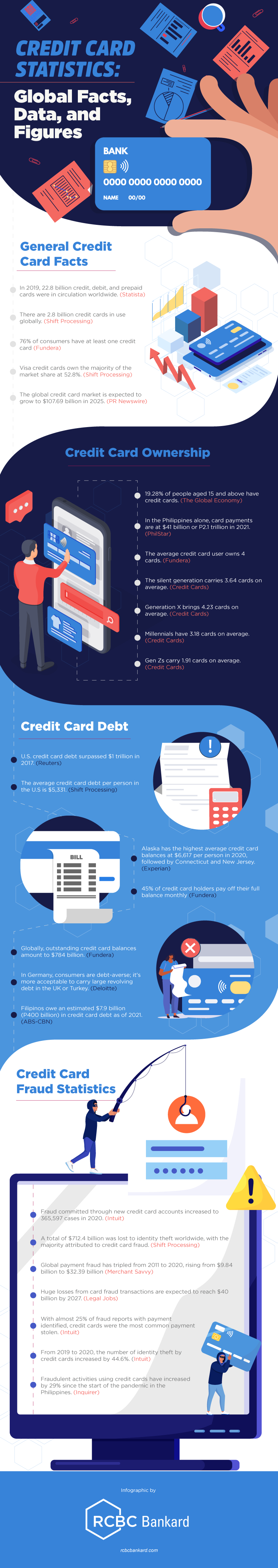

Whether you're applying for your first credit card or you already have one, this infographic will help you learn about global credit card facts, shedding light on why consumers prefer it over other modes of payment.

It's time to dig deeper into what these figures entail. Here are the details behind 26 of the most useful credit card statistics.

General Credit Card Facts

Credit cards are a staple in the global payment ecosystem. Their prominence has especially been growing for the past few years, as proven by the following statistics:

- In 2019, there were approximately 22.8 billion credit, debit, and prepaid cards in use worldwide. This number is set to reach 29.31 billion by 2023. (Statista)

- An estimate of 2.8 billion credit cards is being used globally. (Shift Processing)

- 76% of consumers have at least one credit card (Fundera)

- Visa owns most of the credit card market share at 52.8%, followed by Mastercard with 31.6%. (Shift Processing)

- Given these statistics, it is evident that the credit card industry is rapidly rising. The global credit card industry is expected to grow to $107.69 billion in 2025 at a CAGR of 1.1%. (PR Newswire)

Credit Card Ownership

Credit card ownership and usage are relatively high worldwide. These appear to be influenced by consumer age demographics. Attitude towards credit cards is generally optimistic, with most credit card owners coming from Canada. Similarly, the rising trend is expected to affect the Philippines with a CAGR of 12.3% in the following years.

An analysis of these statistics shows why you should get your first credit card.

- From 2011 to 2017, 19.28% of people aged 15 and above had credit cards. Canada had the most credit cards at 82.58%, while Turkmenistan had the lowest at 0%. (The Global Economy)

- In the Philippines, card payment is believed to hit P2.1 trillion in 2021, with a growth of 15.4%. This can be rooted in the gradual revival of the economy, capped credit card interest rate at 2%, easing of lockdown restrictions, preference for contactless payments, and improved consumer spending. It is forecasted to register a CAGR of 12.3% between 2020 and 2024 to reach P2.87 trillion. (PhilStar)

- The usual credit card user has four cards on average.

- On average, the silent generation, or people 75 years old and up, carries 3.64 cards. Meanwhile, Generation X—those between 40 to 55 years old—brings 4.23 cards on average. From these numbers, it is clear that older consumers tend to have more cards. (Credit Cards)

- Among younger cardholders, millennials, or those between 24 to 39 years old, carry 3.18 cards on average. Generation Z—those with ages between 18 to 23—carries 1.91 cards. (Credit Cards)

Credit cards are rewarding, especially for Gen X. The way it allows cardholders to purchase conveniently, as well as its multiple rewards, makes it an enticing payment option.

Credit Card Debt

The increasing ownership of credit cards directly correlates to credit card debt, or the accumulated outstanding balances that borrowers postpone from month to month. This section will explore which countries have the most credit card debt, the global outstanding credit card balance, the percentage of credit card users worldwide who pay their balance on time, and the average debt per person.

- U.S. credit card debt surpassed $1 trillion in 2017 and was at $868 billion by August 2019. The previous high was $12.68 trillion before the 2008 global financial crisis. This growth can be attributed to the significant consumer purchases due to the relative "affordability" of products and services with credit cards. (Reuters)

- While the U.S. has the highest GDP, their average credit card debt per person is $5,331—exceptionally high compared to other countries with lower GDPs. Evidently, there is no relationship between credit card debt and a country's GDP. (Shift Processing)

- Alaska has the highest average credit card balance at $6,617 per person, followed by Connecticut and New Jersey at $6,040 and $5,978, respectively. (Experian)

- The high credit card debt can be attributed to the low rate of credit card payment frequency; 45% of cardholders pay their balance in full monthly, which means 55% are accruing interest on their spending. (Fundera)

- Global outstanding credit card balances amount to $784 billion, with an average of $2,326.71 in debt per cardholder. The average monthly payment for this debt is $779.83. (Fundera)

- In Germany, consumers are known for being debt-averse. It's more acceptable to carry large amounts of revolving debt in the UK and Turkey. (Deloitte)

- Similarly, Filipinos owe an estimated $7.9 billion (P400 billion) in credit card debt as of June 2021. While many can pay their balance in full or on time, approximately 6% had late or missed payments. Among the 94% that can meet their dues, some are already close to defaulting as the economy struggles.

These statistics show how important it is to pay your balances on time, as it can accumulate to such a hefty and overwhelming sum.

Credit Card Fraud

Credit card fraud is a kind of identity theft that happens when someone uses your credit card or account information to make illegal or unauthorized transactions. Fraud can take place with a stolen, misplaced, or counterfeit credit card. Due to the increasing accessibility of ecommerce that offers credit card payments, credit card fraud has become more prevalent.

- Fraud perpetrated through new credit card accounts increased to 365,597 cases in 2020. (Intuit)

- A total of $712.4 billion was lost to identity theft worldwide, primarily rooted in credit card fraud. The high unemployment rate during the pandemic and the prevalence of digital payments that were easy targets for fraudsters fueled this increase. (Shift Processing)

- Global payment fraud or unauthorized payments tripled from 2011 to 2020, rising from $9.84 billion to $32.39 billion. (Merchant Savvy)

- The world lost over $30 billion to credit card fraud in 2019. Losses from credit card fraud transactions are expected to reach $40 billion by 2027. (Legal Jobs)

- Consisting of 25% of fraud reports with payment identified, credit cards were the most frequent payment stolen. (Intuit)

- From 2019 to 2020, the sum of identity theft by credit cards increased by 44.6%. (Intuit)

- Fraudulent credit card transactions via remote and other digital payment channels increased by 29% in the Philippines since the COVID-19 pandemic-induced lockdowns, underscoring greater vigilance among users. (Inquirer)

The rapid increase in fraud cases highlights the significance of choosing a secure and reputable credit card provider that allows you to monitor your transactions. Moreover, a bank that offers biometrics through PIN or two-factor authentication and utilizes identity or asset management tools can further protect you from being a victim of credit card fraud.

Making Sense of the Numbers

These figures illustrate the convenience that comes with credit cards. However, always be mindful of the debt you can incur and the possibility of fraud. Communicate and consult with your bank if you have any worries about credit card usage, debt, or fraud before applying for one.

RCBC Bankard can guide you in the entire credit card application process and provide you with a wide array of credit card options. They also offer a complete online banking experience with enhanced security through EMV Chip technology, Mastercard E-Commerce insurance, and OTP verification. Open yourself to the many perks from RCBC Bankard credit cards. Apply now!

bc

bc

.png)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

(1).jpg)

(1).jpg)

(1).jpg)

.jpg)

(1).jpg)

(2) (1).jpg)

(2) (1).jpg)

.jpg)

(1).jpg)

(1).jpg)

(1).jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)