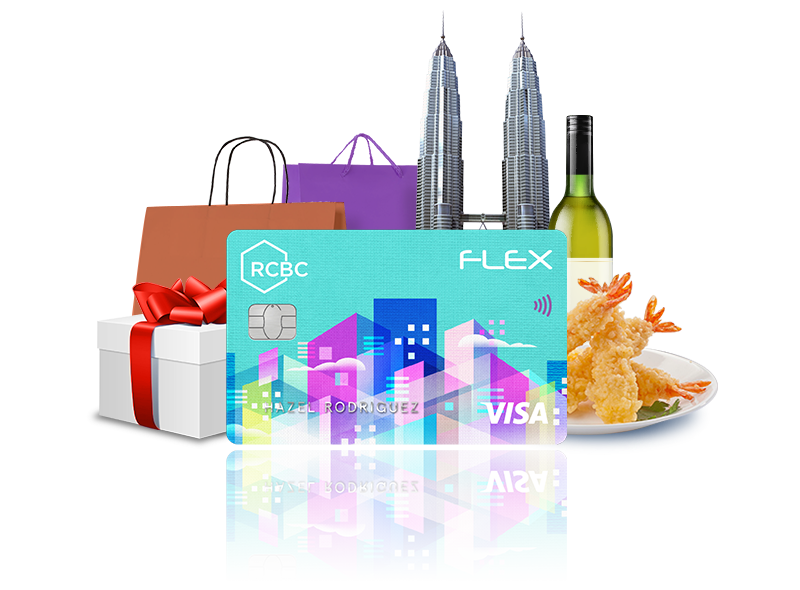

Choose the right RCBC Credit Card for you.

Complete the online application form, submit the required documents, and verify your identity digitally.

We’ll get in touch with you to verify some information on your application.

You will get a notification once your card is on its way to you!

You can also apply at any RCBC branch or RCBC Credit Card sales booths.

Requirements for Employees

*Processing of credit card applications may take from 10 to 15 banking days

| Membership Fee (Principal) |

Php1,500/year |

| Membership Fee (Supplementary) | Php750/year |

| See the latest Interest Rates and Other Fees & Charges here. | |

.jpg)

.jpg)

(1).jpg)